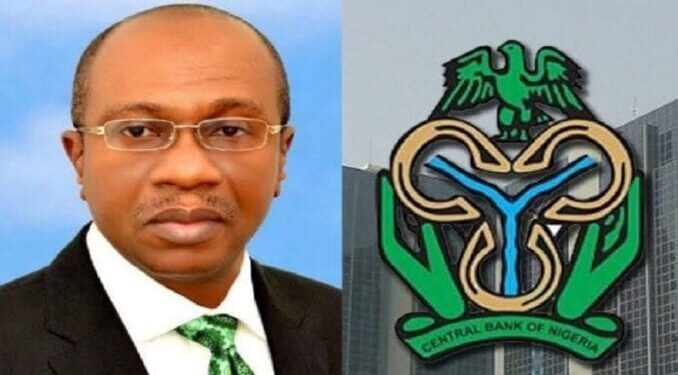

Reps rejects CBN’s presentation on $11 billion power cash – The House of Representatives yesterday rejected the presentation of the Central Bank of Nigeria (CBN) on the $11 billion withdrawn from the Excess Crude Account (ECA) for the National Integrated Power Project (NIPP) following observed discrepancies in the presentation of the CBN and that of the Accountant-General of the Federation.

The Adhoc Committee set up by the House to investigate the power sector however stepped down the consideration of the report of the CBN Governor, Godwin Emiefele who was invited by the committee to explain the withdrawal of $11billion and the N1.514 trillion Nigerian Electricity Stabilisation Facility intervention fund approved and disbursed to Nigerian Bulk Electricity Trading (NBET) company after post-privatisation exercise.

Emefiele who was represented by his Deputy, Adebisi Shonubi did not speak on the withdrawal, but only shed light on the funds given to NBET.

The lawmakers declined the consideration Emefiele’s report because the figures presented contradicted those presented by the Accountant-General of the Federation (AGF), Idris Ahmed and other stakeholders during its previous sitting.

Emiefele said in line with the Federal Executive Council (FEC) approval of N213 billion for NBET, N189.1 billion has been released so far.

He said N60.8 billion has been repaid by the operators who accessed the fund through NBET.

He further said the apex bank also approved N701 billion for the Nigeria Electricity Stabilisation Facility, out of which N694.98 billion was disbursed as at December 2018.

He said further that out of another N600 billion approved for NBET, N85.41 billion has so far been disbursed based on NBET advice.

Read also: Buhari commissions 10mw power plant in Bayelsa state

While stressing that liquidity remains a major challenge facing the industry, the CBN explained that all the intervention funds were 100per cent guaranteed by Ministry of Finance on behalf of the Federal Government.

While responding to question bothering on the state of the crisis bedeviling the power industry, the CBN Governor faulted what he called failure to adhere to the original intendment of the power sector reform, stressing the need to “go back to the intention when the first intervention was conceived.”

On the assessment of utilisation of the N1.514 trillion disbursed as contained in the CBN Governor’s report, he said NBET is solely responsible for such oversight.

He said fund were provided with the view to enabling the new investors to clear the legacy debts inherited from the defunct Power Holding Company of Nigeria (PHCN) before the privatisation of power assets.

However, reviewing the CBN Governor’s presentation, Chairman of the Committee, Hon. Doguwa chided the apex bank for undermining the institution of the parliament, while frowning at the discrepancies in the presentation of the bank.

Hon Doguwa said: “Like I said earlier on, part of the issues we find ourselves, this issue has to do with facts and figures you have presented. I believe you can agree with me those of you are very used to numbers and tabulation can quickly rush into this kind of calculation and make recommendations thereafter.

“I want to speak on behalf of my members that this presentation of this nature with this kind of sensitivity on disbursement of funds of N600 billion, N701 billion.

“As far as we are concerned is very huge amount of Nigerian tax payers money that basically we need to have to take some time to look at. While we are doing that, we will come up with necessary observations which will be there for you to provide answers.

“Without taking the risk of going back to what I said earlier, doing this in this kind of manner makes our work practically difficult dealing with huge amount of money.

“Sometime, we are also taking contrary submissions from other agencies. Like in the case of the N600 billion from which you now succinctly said that you have only disbursed N85.4 billion, the records we have gotten from the Ministry of Finance is completely different to a significant amount of money.”

“The NBET also made similar statement. If these three or two other agencies were here or you the Almighty central bank was there then, I think these are issues we can just put our heads together and resolve and find out where the problem lies.

“I believe we still have a very difficult work to handle. I want to once again reemphasis that we appreciate the time that you have spared to honour the people of Nigeria in the parliament. That’s not withstanding, I still want to say that some of these things may not be exhaustively discussed here today. So, I will allow members to still go ahead and ask questions based on what they have been able to comprehend.”

While stressing the need to halt deliberation on the CBN Governor’s submission, Doguwa who is also the House Leader said: “I will allow members to ask questions but with the restriction, please reserve your questions on this submission for now because you basically need time to study this submission and at the end we can do the right thing at the right time, so that we can subsequently guide the House appropriately.”

Read also: Sanusi advises CBN to Fund BDC for naira stabilisation

The Accountant-General of the Federation had in an earlier presentation to the Committee claimed that $8.234 billion expended on NIPP between 2005 and 2007 from the ECA by the Federal Executive Council comprising the state governors.

Breakdown of the fund showed that $2,859,390,31.61 from 2005 to 2007, while the mandates were issued to CBN for $3,068,167,378.92, while mandates for $364,513,747.31 were not applied by CBN and $364,513,747.31 was reversed.

The breakdown of the funding of the Niger Delta Power Holding Company (NDPHC) and NIPPs contributed by the three tiers of government showed that Federal Government contributed $3,773,952,839.22 (45.83per cent); states contributed $2,984,670,057.16 (36.25per cent) while Local Government Councils contributed $1,475,767,435.23 (17.92per cent).

Also making a presentation, Director General of Debts Management Office (DMO), Ms. Patience Oniha said that a $1 billion Eurobond commercial loan was sourced from investors at commercial rate sequel to the approvals of the Federal Executive Council and National Assembly for the power sector.

She also told the lawmakers that of the $150 million loan sourced by Rural Electrification Agency (REA) under the Nigerian electrification project, out of which $0.71 million (representing 1.47per cent) has so far been released to the agency by the Development Partner and attracts five years moratorium with a 20 years repayment plan.