CBN under pressure to unify exchange rate for naira – THE International Monetary Fund (IMF) has urged the Central Bank of Nigeria (CBN) to get the country a unified exchange rate for the naira.

It remained stable at N378 to dollar on the CBN’s official rate.

The naira was on Sunday exchanging at N500 to dollar at the parallel market.

The currency got to a long-time low after weakening by N4 from N496 to dollar it closed on Friday.

The IMF said the Nigerian economy is struggling with multiple shocks, and is expected to grow by -4.3 per cent in 2020 before a modest recovery in 2021(1.7 per cent).

The IMF said exchange rate rigidities have constrained the economy’s ability to absorb external shocks. It called for unified exchange rate for the naira to promote growth and attractive foreign capital.

According to the IMF, foreign exchange backlog and shortages are intensifying Balance of Payment (BoP) pressures insisting that exchange rate unification was imperative to reduce BoP risks.

IMF said fiscal deficit will stay elevated in the medium term, while additional domestic revenue mobilisation is required to reduce fiscal risks.

The Fund further stated that fiscal transparency measures to be introduced to facilitate tracking. It also advised that the dependence on Central Bank of Nigeria’s overdraft for fiscal funding should be annulled, adding that conflicting objectives have undermined monetary policy effectiveness. The Fund advised that policy strategy should be strengthened to establish price stability.

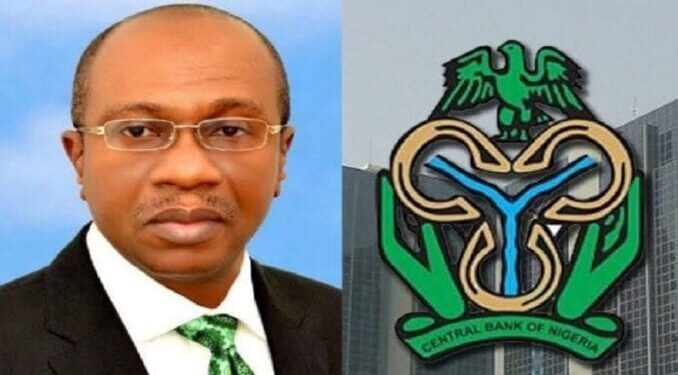

CBN Governor Godwin Emefiele said the economic challenges posed by COVID-19 pandemic to Nigeria and other global economies will soon end with the discovery of vaccines to tackle the heath problem.

Read also: IMF predicts 5.2% decline in Nigeria’s GDP in 2020

Speaking at the Annual Bankers Dinner, organised by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos, the apex bank boss said coming of vaccines will also help to support growth in the medium term, by aiding full restoration of economic activities particularly in service related sectors such as education, aviation, hospitality and tourism.

Nigeria’s Gross Domestic Product (GDP) contracted by -3.4 per cent in the third quarter, a welcome improvement from the – 6.1 per cent recorded in the second quarter.

The contraction, however officially put the economy in recession, which the apex bank said it will exit by first quarter of 2021.

Emefiele said the negative rate of growth was due to a series of external factors in addition to the lockdown measures, imposed in order to curtail the spread of the virus.

Additionally, the apex bank boss said the emerging reports on progress in developing a vaccine by several firms is reassuring, as it indicates that a solution to the health challenge is in sight.

He said now is a challenging time for Nigeria, taking into account the impact of COVID-19 on the global economy.

“In Nigeria, we had to address the public health challenge, in addition to implementing a variety of policy measures aimed at reversing the unprecedented downturn in economic activities during the first half of the year,” he said.

The apex bank boss provided assessment of the measures taken by the regulator in addressing the impact of the COVID-19 pandemic on the Nigerian economy, as well as outlook on the path ahead.

“As we are all aware, prior to the onset of the virus in December 2019, the Nigerian economy was on a positive growth trajectory, having made a significant recovery from the 2016-2017 recession, which was triggered by the drop-in commodity prices in 2016,” he said.

Emefiele explained that following the recession, Nigeria witnessed 12 consecutive quarters of economic expansion, and Gross Domestic Product (GDP) growth in the fourth quarter of 2019 stood at 2.55 per cent.

He said before the pandemic, Nigeria’s exchange rate remained stable for over two years at N360/$ and external reserve witnessed significant accretions from the sale of crude oil and continued inflows from foreign investors.

“Our banking system remained strong, as key indicators reflected improvements across several areas. Capital adequacy ratio for the banking industry was above 15 per cent, surpassing the prudential requirement. The ratio of non-performing loans declined from 11 percent in April 2019 to less than 6.1 per cent by January 2020. Our intervention efforts in the agriculture and manufacturing sectors continued to support employment generating activities and improved local production of goods that can be produced in Nigeria,” he said.

Emefiele said the onset of the COVID-19 pandemic in the first half of 2020, and the lockdown measures put in place to contain the spread of the virus, caused an unprecedented shock to the global economy. Global economic downturn, which was particularly significant in the second quarter of the year, saw declines in growth in advanced and emerging market countries.

The United States economy declined by (-9.5 per cent), United Kingdom (-20 per cent), India (-24 per cent) and South Africa (-17 per cent).

As a result, far-reaching measures were taken by fiscal and monetary authorities in advanced and emerging markets to stabilise their respective economies.

He explained that like other economies, the Nigerian economy was not immune from the COVID-19 shock in 2020.

Emefiele said restriction on global travel by land and air; along with the slowdown in commercial activities, led to a significant reduction in the demand for crude oil, which contributed to a 65 percent decline in crude oil prices between January and May 2020.