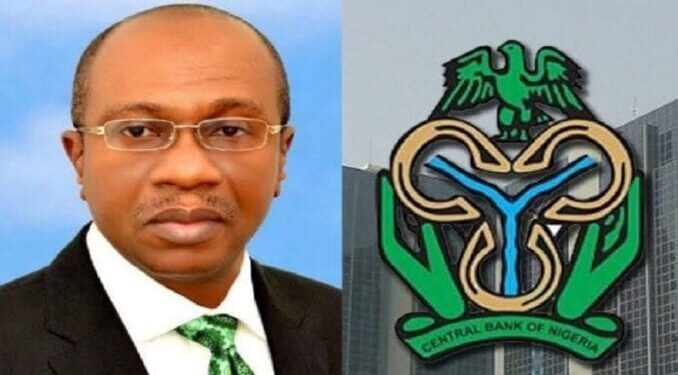

CBN May Soon Lift Ban on Crypto Trading – The Central Bank of Nigeria (CBN) may eventually lift the ban it placed on the trading of cryptocurrencies in the country earlier this year.

In February 2021, the apex bank issued a circular to commercial banks, directing them to close all bank accounts linked with crypto trading.

Many Nigerians believed that this action was taken to punish the several youths who partook in the controversial #EndSARS protest in October 2020, which those in government felt was used to embarrass President Muhammadu Buhari.

Many citizens had been making good money from buying and selling digital currency until the CBN came up with the circular that has changed the game.

The development came at a time the Securities and Exchange Commission (SEC) was making efforts to embrace digital assets like others across the globe and look for ways to properly regulate the industry.

On Thursday, at a post-Capital Market Committee (CMC) meeting news briefing, the Director-General of the commission, Mr Lamido Yuguda, hinted that things would soon be resolved.

According to him, the agency was working with the CBN for a better understanding and regulation of cryptocurrencies in the country.

“We are in discussion with CBN for both understanding and better regulating of this market. We will be able to come back to you later to inform you of the outcome of these engagements.

“But because of the lack of access to commercial bank accounts, we had to suspend our own guidelines of September 2020. The implementation of that circular is suspended until these operators are able to have access to Nigerian bank accounts.

“Remember that nobody operates in the Nigerian capital market if that person does not have access to a Nigerian bank account,” he said.

The SEC DG clarified that the commission had always provided support to financial technology companies and had invested so much in developing a framework to support their operations.

He said, “Let me say that the SEC remains very supportive of fintechs. We have invested so much in developing a framework for supporting fintechs in the various areas and fintechs are acting in areas of crowdfunding, investment advice and cryptocurrencies and the like.”

Mr Yuguda, however, accepted that the ban had affected the growth of the fintech market in Nigeria.

He said, “In all other areas, nothing has changed, but in the area of crypto assets, you know that with the recent prohibition by the CBN on access to Nigerian bank accounts by crypto exchanges, that market has been disrupted.

“And the truth of the matter is that while the SEC had issued guidelines in September 2020 aimed at regulating this market, for now for all intents and purposes, because these exchanges do not have access to commercial bank accounts in Nigeria, the market, for now, does not exist.”

Osinbajo supports crypto trading

Recall that shortly after the CBN announced the ban on crypto trading in the country, the Vice President, Mr Yemi Osinbajo, said it was a wrong step. He advised the apex bank to consider regulating the sector rather than prohibit cryptocurrencies because it was the future of money in the world.

Read also: Banks, hotels, others back in business as govt lifts lockdown

Mr Osinbajo had said “we must act with knowledge and not fear” and develop a robust regulatory regime that is thoughtful and knowledge-based.

“I fully appreciate the strong position of the CBN, SEC and some of the anti-corruption agencies on the possible abuses of cryptocurrencies and their other well-articulated concerns. But I believe that their position should be the subject of further reflection.

“There is a role for regulation here. And it is in the place of both our monetary authorities and SEC to provide a robust regulatory regime that addresses these serious concerns without killing the goose that might lay the golden eggs.

“So, it should be thoughtful and knowledge-based regulation, not prohibition. The point I am making is that some of the exciting developments we see the call for prudence and care in adopting them, but we must act with knowledge and not fear,” he added at an event organised by the CBN, the Banker’s Committee and the Vanguard Newspaper.