CBN facilitation for Nigeria’s participation in AfCFTA – The Federal Government approved the ratification of the African Continental Free Trade Area (AfCFTA) agreement in November 2020, and deposited the instrument of ratification on Dec/ 15, 2020, thus becoming the 34th State Party to ratify the treaty.

AfCFTA is projected to benefit the country by creating larger market access, free movement of labour, goods, services and capital. It is also expected to boost the country’s revenue through economic diversification from crude oil to value added goods and services.

The AfCFTA agreement is expected to, among others; motivate Nigerian Small and Medium Enterprises (SMEs) to expand their businesses to other African countries, foster business growth and increase profit.

It will also contribute substantially to the development of the manufacturing sector, and increase job opportunities and the demand for labour that will ultimately lead to reduction in unemployment and create opportunity for Nigerian professionals to seek employment in other African countries.

While agreeing that AfCFTA will benefit the country immensely by creating enlarged, continental markets for trade in goods and services, the Central Bank of Nigeria is playing a critical role to facilitate successful participation of Nigerians in the initiative.

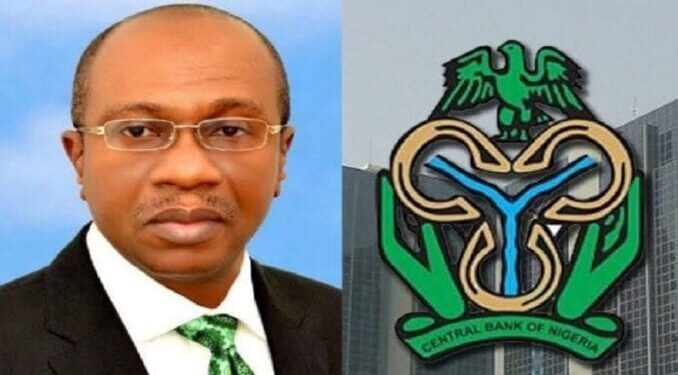

The CBN Governor, Mr Godwin Emefiele, says when fully implemented, AfCFTA will afford Nigerian companies preferential access to African markets worth 504.17 billion dollars in goods and 162 billion dollars in services.

At the Zenith Bank’s 2021 Export Seminar recently in Lagos, Emefiele urged Nigerian businesses to seize the AfCFTA opportunity to ensure that Nigeria served as a significant hub for international and domestic manufacturing companies seeking to serve the West, Central and East African Markets.

CBN’s Deputy Governor for Economic Policy, Dr Kingsley Obiora, said that the apex bank had been implementing various development finance programmes aimed at stimulating the real sector activities and diversifying the economy particularly in the agriculture, manufacturing, healthcare and other non-oil sectors.

Obiora, at a Town-Hall Meeting with Financial Sector stakeholders, said: “The interventions include the Anchor Borrowers’ Programme, the Real Sector Support Facility, Export Stimulation Scheme and the Commercial Agricultural Credit Scheme

“These examples are indications of CBN’s involvement and commitment to growing our domestic industries and boosting international competitiveness, particularly in preparation for the AfCFTA.”

He said that the financial sector stood to reap immense benefit from the agreement due to the removal of certain barriers.

“We believe that the financial sector has the potential to accrue substantial benefits from the AfCFTA in view of the intermediary role of finance in facilitating growth and engendering sustainable growth.

“The critical advantage of the AfCFTA to the Nigerian financial sector would be the removal of barriers for the expansion of financial institutions and services. This advancement will foster the provision of financial service in the continental market at a reduced cost,” he said.

According to Dr Hassan Mahmud, CBN’s Director, Monetary Policy, the apex bank has a leading role to play in positioning the Nigerian financial sector to harness the potential benefits of the agreement.

Mahmud said that the CBN’s monetary and trade policies were aimed at maintaining macroeconomic stability and promoting non-oil exports.

He said that the success of AfCFTA would depend on the ability of Africa’s financial service industry to serve as effective intermediaries.

“ So far, Nigerian banks are currently ranked among the largest banks in Africa, with branches across countries.

“These banks with branches across the continent have an advantage that can be used to strengthen the participation of other sub-sectors. For instance, the banks can broaden their activity sphere into other areas of finance,’’ he said.

CBN’s Director of Banking Supervision Department, Mr Haruna Mustafa, said that the apex bank saw AfCFTA as a vista of opportunities for the Nigerian banking sector, which has a crucial role to play in the successful implementation of the agreement.

“But they need to be well capitalised to be able to finance big ticket transactions. They also need to scale up in terms of their payment infrastructure to be able to reach out to Pan-African market. In addition, they should operate at the highest standard of their businesses to gain the confidence that will attract patronage to them,” he advised.

Mustafa said that AfCFTA would boost intra-African trade and global trade with 90 per cent tariff liberalisation, adding that it would enhance growth potential for intra African Trade by 52.3 per cent and global trade by six per cent by 2022.

“It will lift 30 million Africans out of extreme poverty. It will also provide an opportunity for the Other Financial Institutions (OFIs) to provide more credits to the Micro, Small and Medium Enterprises (MSMEs) that are engaged in the production of goods and services for export,’’ he said.

He added that this would provide opportunities for financial institutions to grant more credits that would grow their finances and earn them more income.

“Capitalisation will make the Nigerian financial institutions competitive to explore opportunities provided by the AfCFTA.

“They should adopt the International Financial Reporting Standards ( IFRS) and apply good business practices,” he said.

He called for the strengthening of cross border supervision of banks through capacity building of home and host supervisors to improve efficiency.

Mrs Nkiru Asiegbu, Director, OFI Department of the CBN, said that Development Finance Institutions, Discount Houses, Finance Companies, Holding Companies, Merchant Banks, Micro-finance Banks and Bureaux de Change were engine rooms for economic growth through their provision of financial services to economic agents operating in the real sector.

Asiegbu added that the implementation of AfCFTA agreement would result in the free movement of people, goods and services as well as increase trade among member states.

“It presents many opportunities which all OFIs in Nigeria can exploit to the benefits of institutions, shareholders and the economy at large,’’ she said.

She urged the OFIs to clean up their books, adopt International Financial Reporting Standards and improve their internal control systems.

“Some of the OFIs are already undergoing a recapitalisation drive to strengthen them to be more competitive.

“They should train their staff and rejig their business practices. They should continue to engage other stakeholders, and support small businesses to take full advantage of AfCFTA,” she said.

She added that with AfCFTA and the support of these financial institutions, MSMEs would be enabled to produce goods and services for export.

“We expect an increase in trade in the continent and MSMEs should be able to produce goods and services for export”, she said.

Dr Ozoemena Nnaji, Director, CBN’s Trade and Exchange Department, however, suggested that a lot of bottlenecks needed to be removed for Nigeria to reap maximum benefits from the AfCFTA agreement.

She commended ongoing efforts by the Federal Government towards improving the business environment.

“Such efforts should be sustained and improved on, in order to grow the economy, promote export and harness the potential gains of the AFCFTA.

“Exporters should put concerted efforts in areas of competitive and comparative advantage, in order to maximise the benefits of the AFCFTA,’’ she suggested.

Nnaji identified the need to address the issue of logistics at the existing ports of entry, as well as the opening up of additional ports to accommodate the volume of expected trans-continental trade.

“We should also look at attracting more foreign direct investment into critical sectors of the economy. We should improve on the manufacturing sector to boost the economic diversification agenda.

“Nigeria is the second largest exporter on the African continent, accounting for about 19 per cent of all exports in 2020. We should, therefore, work to improve on that,” she said.

According to Mr Yila Yusuf, CBN Director of Development Finance, the success of AfCFTA depends largely on the ability of Africa’s financial service industries to serve as effective intermediaries.

Yusuf revealed that with the implementation of the AfCFTA agreement in January, the CBN introduced several initiatives that could support the local players to take full advantage and compete among the member countries.

“ This includes enhanced access to finance in high impact sectors of the country; support to the Federal Government Economic Sustainability Plan for the economy to bounce bank post COVID-19, as well as granting interest rate moratorium to support the recovery from COVID-19,’’ he said.

As the apex bank, the CBN facilitation for a successful participation of Nigerians in the AfCFTA will go a long way in making the Nation the giant economic base of the continent as well as open up vistas of opportunities for Nigeria to effectively play it big brother role in the continent and the world.

I register my n power yourth loans on February’s am yet to receive the loan u b a account number 2112306047