Digital Dollar Is Most Important for America to Keep the USD as World’s Reserve Currency – Analyst: The U.S. is soon to release its official discussion paper on its CBDC Research aka the Digital Dollar. This has got the world watching as to what major steps the world’s largest economy will incorporate.

While the U.S. has been pretty slow in the development of the Digital Dollar, things are taking turns for the good. The Fed governor Lael Brainard recently said that America doesn’t have an option of not taking the Digital dollar seriously.

China has already accelerated its development of the Digital Yuan as it seeks to reduce its dependency on the use of USD. In an interesting thread on Twitter, analyst Tascha explains how the Digital Dollar can help America keep up with the status of USD being the world’s reserve currency.

Analyst Tascha’s View on digital Dollar

Over the years, America’s debt has been mounting and has aggravated further with this pandemic. As of date, the USD contributes to 40-50% of the global trade settlements and international credits. In a way, we can say that America’s biggest export is its own national currency, notes the analyst.

This gives America the leverage to play around with its monetary policy and increase debt. Interestingly, post the Bretton Woods agreement in World War 2, the U.S. has turned into a net importer.

Since the USD serves as the store of value and medium of exchange, its value grows as the global trade continues to expand. Since other countries are keen on getting the USD in their treasury, the U.S. continues to accumulate debt simultaneously being the net importer.

Now, if the U.S. wants to lower its debt, it cannot reduce the imports. Pulling the plugs off the consumption story could mean slowing down the economy and a foolish move. Rather, the other way is to increase the value of USD exports.

For this, the Federal Reserve has to make “the USD money network bigger and easier to use,” writes the analyst. Thus, to grow the network, it must bring more users using the U.S. Dollar.

Now the fact that the U.S. is a net importer might put us in the delusion that the value of the USD network is increasing. But in reality, it’s on a decline.

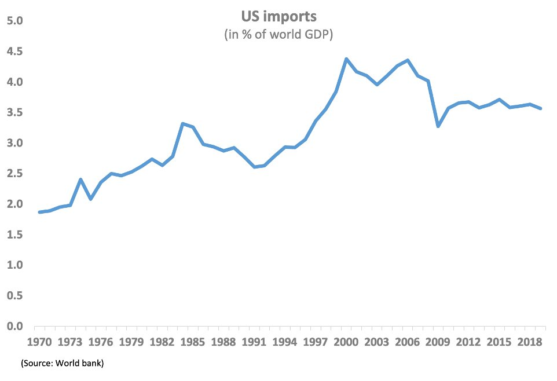

While other countries get their hands on the USD through their exports, the net imports by the U.S. are on a decline in the last two decades. Thus, fewer imports of goods and services mean fewer exports of the USD by America.

Leverage Digital Technology to Expand the Money Network

On the supply side, the growth of USD network value remains limited. But analyst Tascha notes that the internet + digital currency can help in growing the money network at a low cost.

Other countries have been already keen on accumulating the USD. Thus, if the Fed unveiled its digital currency, the demand will explore further. The analyst provides a six-step framework to implement this:

- Issue a digitalUSD token available to the whole world.

- Call on your big tech companies to build distribution.

- Let the stablecoins live.

- Nip the dollar appreciation in the bud.

- Get more digitalUSD token deployed abroad by investing overseas. (Follow the China-way is basically what she means)

- Enjoy reserve currency status for another 20 years.

The analyst explains each of these points in detail in her Twitter thread.