Power players and shifting sands in the global smartphone market – In the complex web of global trade, the smartphone industry is one of the few that gets as much attention as it does. As these devices become more important to our daily lives, it is important to understand how they are made and distributed. Let’s get to the bottom of this complex fabric.

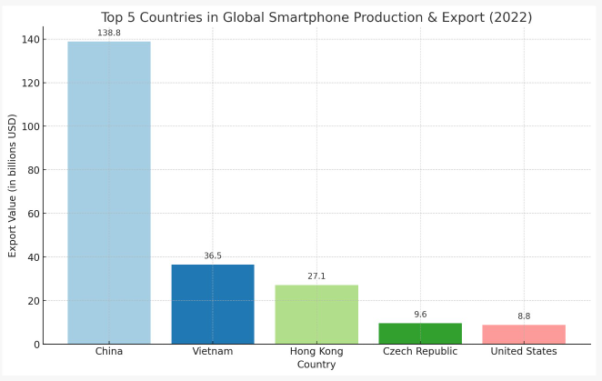

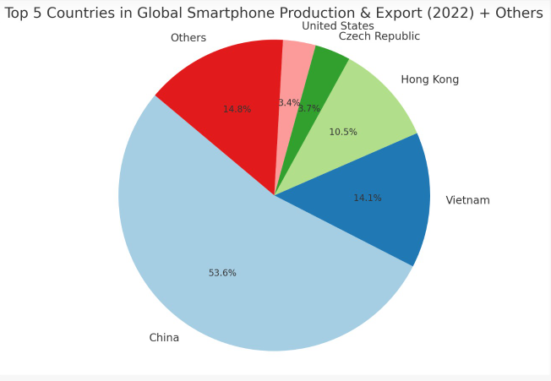

One can’t start talking about this without bringing up the elephant in the room, which is China’s huge 52.4% share of global smartphone exports. With $138.8 billion in exports, it’s clear that the Middle Kingdom’s combination of manufacturing know-how, long supply lines, and growing tech hubs is unmatched. Tech giants like Huawei and Xiaomi aren’t just important to their home countries.

Vietnam and Hong Kong have become very strong competitors to China. Their rise shows a bigger trend: the Asia-Pacific region is becoming more important in making electronics. From the busy tech hubs in India to South Korea’s economy that is driven by innovation, the region is becoming the world’s smartphone factory.

The part Europe plays in this story is interesting. Even though they don’t lead the pack, countries like the Czech Republic and Germany show Europe’s quiet but steady influence by making up nearly 12% of the world’s exports. It looks like the continent has decided to play the long game by focusing on niche markets and new ideas.

Surprisingly, even though it is home to Silicon Valley and tech giant Apple, the U.S. only ranks fifth in exports. Even though the United States only makes a small amount of smartphones, its design and software innovations are still unmatched.

Vietnam deserves special attention. Once a quiet player, it is now the second biggest exporter of smartphones in the world. Vietnam shows how being flexible and coming up with new ideas can help a country get to the top. Brands like VinSmart have a big part of the market there.

China’s Tecno Mobile is an interesting side story. By customising its products, Tecno has become a well-known brand in Africa, which is set to become the next big market for smartphones.

The concentration of power, on the other hand, is what stands out the most. 96% of all exports come from the top 20 countries, leaving only 4% for the rest. This uneven spread makes me wonder about market monopolies and what will happen to competition in the future.

The world of making and selling smartphones is both a great example of how people from all over the world can work together and a very competitive place. As technology changes and geopolitics plays out, it’s hard to say how this scenario will change. At the moment, everyone’s attention is on the East, but in a world that changes so quickly, it’s hard to know what will happen next.