Lagos, Nigeria – Nigeria’s banking sector is experiencing unprecedented recapitalization momentum as financial institutions rush to meet regulatory requirements ahead of the Central Bank of Nigeria’s March 2026 deadline. According to Agusto & Co.’s comprehensive 2025 Nigerian Banking Industry Report, an additional ₦900 billion in capital injection is expected to flow into the sector before the end of 2025, building on the ₦2.5 trillion already raised over the past 19 months.

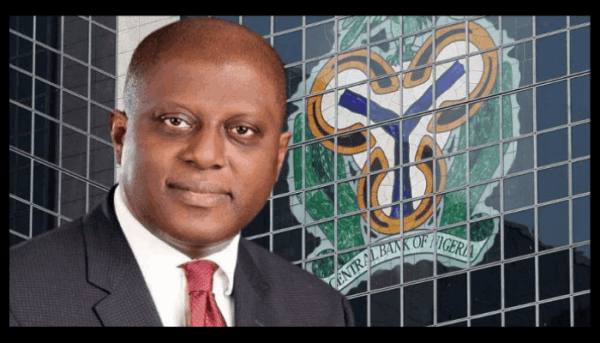

The recapitalization drive stems from CBN Governor Olayemi Cardoso’s March 2024 directive requiring commercial banks with international authorization to increase their minimum capital base to ₦500 billion, national banks to ₦200 billion, and regional banks to ₦50 billion. This ambitious mandate aims to position Nigeria’s financial system to support the government’s vision of achieving a $1 trillion economy by 2030.

Since the directive’s implementation, 16 banks collectively raised approximately ₦1.7 trillion in 2024, followed by an additional ₦800 billion in the first seven months of 2025. Eight banks have already met the minimum capital requirements ahead of the deadline, though some raised funds still await mandatory verification by the CBN and Securities and Exchange Commission.

The recapitalization has gained significant traction across social media platforms, with banking institutions leveraging influencers on Twitter, Facebook, Instagram, and TikTok to promote their capital-raising initiatives to retail investors. This digital marketing strategy reflects the sector’s adaptation to contemporary financial inclusion approaches, particularly as banks like Access Holdings, GTCO, and Fidelity Bank utilize social media campaigns to attract investment from younger demographics.

Nigeria’s banking recapitalization occurs within the broader context of African financial sector consolidation, where major continental players are positioning for expansion. South African banking giant FirstRand has expressed interest in entering Kenya’s market, capitalizing on similar capital requirement increases that have created acquisition opportunities. This trend highlights the competitive landscape Nigerian banks face as they strengthen their capital bases to compete regionally.

The initiative has drawn comparisons to Kenya’s earlier banking sector reforms, where the Central Bank of Kenya increased minimum capital requirements from KES 250 million to KES 1 billion by 2012, resulting in significant sector consolidation. Similarly, Egypt’s banking sector has maintained capital adequacy ratios well above the regulatory minimum of 10 percent, demonstrating the success of robust capital requirements across African markets.

Banking sector experts and social media commentary have been largely supportive of the recapitalization efforts, with many viewing the exercise as necessary for financial stability and economic growth. YouTube discussions and financial analysis videos have highlighted the strategic importance of stronger banks for supporting large-scale infrastructure projects and enhancing Nigeria’s competitiveness in global markets.

The recapitalization has also attracted international attention, with domestic investors providing the majority of capital raised over the past 19 months, reflecting strong local confidence in Nigeria’s banking sector. This domestic investment pattern contrasts with some African markets where foreign capital plays a more dominant role in banking sector funding.