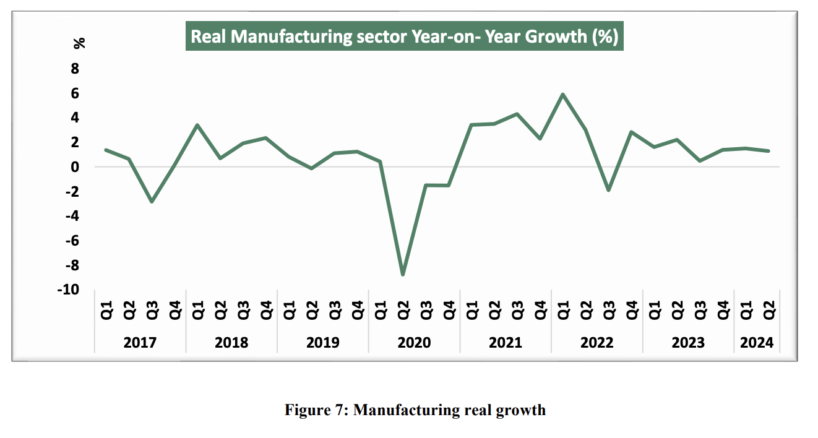

Nigeria’s Manufacturing Sector Struggles in Q2 2024: Growth Slows Amid Economic Challenges – Nigeria’s manufacturing sector, once seen as a key driver of economic diversification, faced significant challenges in the second quarter of 2024, according to the latest GDP report from the National Bureau of Statistics (NBS). The sector recorded a modest real GDP growth of just 1.28% year-on-year, marking a slowdown compared to previous quarters and highlighting the difficulties facing manufacturers in the current economic climate.

This slowdown in growth is particularly concerning when viewed against the backdrop of Q2 2023, where the manufacturing sector grew by 2.20%. The decline in the sector’s growth rate raises alarms about the sustainability of Nigeria’s industrialization efforts, as the sector is crucial for job creation and economic stability.

One of the most significant areas of concern is the Oil Refining sub-sector, which saw a dramatic contraction. Real GDP in this sub-sector plummeted by 31.14% in Q2 2024, following a similar decline of 30.67% in Q1 2024. This steep decline can be attributed to ongoing challenges in the oil and gas industry, including fluctuating global oil prices, infrastructure deficiencies, and operational inefficiencies within Nigeria’s refineries.

Other key manufacturing sub-sectors also struggled during the quarter. The Cement sub-sector, which is typically a bellwether for construction activity and broader economic health, grew by a mere 1.86% in nominal terms, a sharp decline from the 24.16% growth recorded in Q2 2023. The slowdown in cement production is reflective of a broader contraction in the construction sector, which grew by just 1.05% in real terms during the same period.

The Textile, Apparel, and Footwear sub-sector, once a vibrant part of Nigeria’s manufacturing landscape, recorded a decline of 0.14% in real terms. This negative growth highlights the persistent challenges of operating in an environment characterized by high production costs, poor infrastructure, and competition from cheaper imports. The sector’s struggles are emblematic of the broader issues facing manufacturers across Nigeria, including limited access to finance, unreliable power supply, and a challenging regulatory environment.

Even sub-sectors that traditionally perform well, such as Food, Beverages, and Tobacco, showed signs of strain. This sub-sector grew by only 2.53% in Q2 2024, a significant drop from the 6.03% recorded in Q1 2024 and the robust 36.73% growth seen in Q2 2023. The slowdown here reflects broader economic pressures, including rising inflation, which has eroded consumer purchasing power and impacted domestic demand for manufactured goods.

Moreover, the overall contribution of the manufacturing sector to Nigeria’s GDP has diminished. In Q2 2024, the sector contributed 8.46% to real GDP, down from 8.62% in the same quarter of 2023 and significantly lower than the 9.98% recorded in Q1 2024. This decline underscores the sector’s struggles to maintain its share of the economy amidst growing challenges.

The negative trajectory of the manufacturing sector raises serious concerns about Nigeria’s ability to achieve its industrialization goals. While the government has made efforts to promote local manufacturing through policies aimed at reducing imports and encouraging domestic production, the sector’s recent performance suggests that more needs to be done to create a conducive environment for manufacturers.

Industry stakeholders have called for urgent reforms to address the structural issues plaguing the sector. These include improving infrastructure, particularly in the areas of power supply and transportation, as well as creating more favorable financing conditions for manufacturers. Without these critical interventions, the sector’s growth could continue to stagnate, with far-reaching implications for Nigeria’s broader economic development.

As Nigeria navigates the complexities of a post-pandemic world and global economic uncertainties, the performance of the manufacturing sector will be a key indicator of the country’s economic resilience. The current slowdown serves as a wake-up call for policymakers to take decisive action to revitalize this vital sector and ensure it contributes meaningfully to Nigeria’s economic recovery and long-term growth.